Florida Insurance Claims Attorneys

Insurance litigation usually involves disputes concerning contracts or policies of insurance in the state of Florida and federal civil courts. In certain cases, insurance companies owe legal duties to persons with whom they do not have a contractual relationship.

Some examples of insurance coverage include:

Most insurance disputes involving insurance policies are governed by state statutes. These statutes allow the policyholder to collect attorney’s fees if successful in a lawsuit against their own insurance company. Insurance companies also have a legal duty to act fairly and honestly toward both their policyholders and the insured. This duty includes the legal duty that they settle claims and protect their insured from lawsuits when presented with a reasonable opportunity to do so.

Get started with a free initial consultation; call (954) 504-6577 or contact us online.

Insurance bad faith cases typically arise when a liability insurer refuses to pay their policy limits to a claimant when it is clear that the claimant’s case has a potential jury value equal to or in excess of the insurance policy amount. Consequently, their policyholder or insured gets sued, and when a jury returns a verdict in excess of the policy amount, the policyholder or insured becomes personally liable for the amount over the policy limits. The policyholder may then have a potential bad faith case against its own insurance company for failing to protect him or her from personal liability.

Some examples of insurance bad faith:

- Failure to promptly investigate or perform due diligence

- Failure to act within a reasonable time

- Denial or delay of a claim without reason

- Undervaluing or underpaying a claim

- Delay in payment while waiting on a settlement with a third party insurer

- Cancellation of insurance policy unjustly

The claimant receiving the verdict or judgment in excess of the policy limits may also have a potential bad faith case against the insurance company for failing to settle for the policy limits when it had a chance.

When referring to “bad faith” in regard to insurance, it basically means that your insurance company has not followed through on their end of the contractual agreement. If an insurance company fails to meet their terms of the contract with a policyholder and do not settle claims that are valid when they should, they are working in “bad faith”.

Insurance bad faith can apply to any type of insurance claim – whether that is automotive, life, health, property, professional liability, disability, among many other types of claims.

As a policyholder, you are entitled to a set of rights under your insurance policy because it is a contract. As long as you follow through on your commitment to paying your premiums, your insurer is required to pay the benefits if the conditions laid out in the policy’s contract happen. Insurance companies are legally obligated to work in good faith with their policyholders.

Contact An Experienced Law Firm

There are times when insurers are permitted to deny a claim only if the consumer has not met the full requirements that are identified in the insurance policy. Insurers can also deny a claim if the consumer has failed to pay their premiums or if the claim is not covered per the contract. They can also deny a claim if they suspect it is a fraudulent claim.

If your claim has been rejected, you should contact an experienced insurance litigation law firm and request the services of qualified insurance litigation that specializes in bad faith cases in regard to insurance. Because insurance bad faith is such a niche field, it is critical that you hire the services of the right type of attorney. Once your lawyer reviews your specific case, you will have a better idea of the necessary next steps.

Many people wonder why insurance companies commit bad faith when it comes to their policyholders. In most cases, it is because of money. Insurance companies are for-profit companies. This means that when they deny a claim or do not provide the full compensation or benefits for a claim, they end up saving money. Many insurance companies are aware that most policyholders will not try to dispute or fight back against an underpaid or rejected claim.

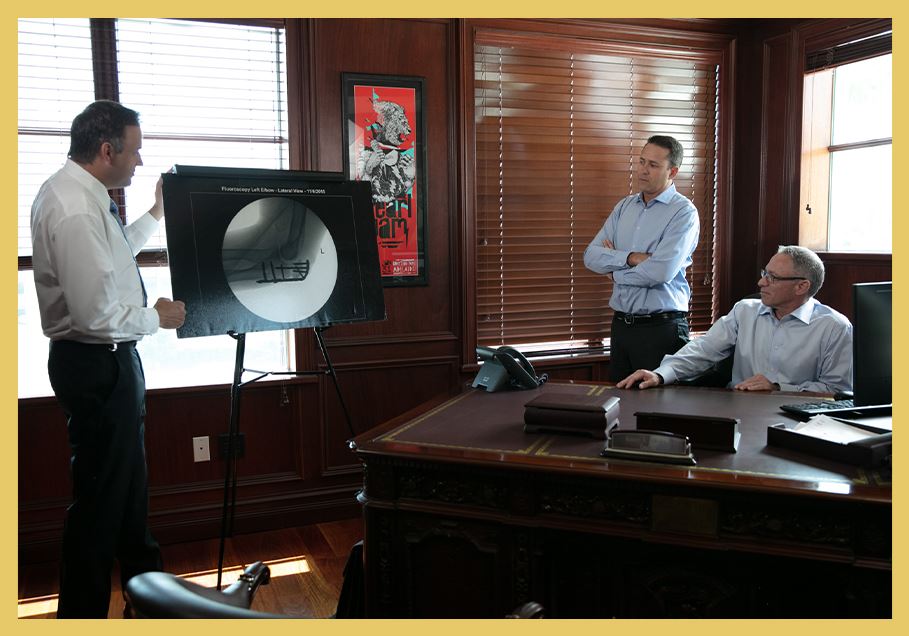

The attorneys at Zimmerman & Frachtman have handled numerous bad faith cases. Our lawyers are skilled in evaluating and prosecuting insurance bad faith claims. If you, a family member, or a friend has been a victim of bad faith and would like to learn more about your legal rights, please contact us here or call (954) 504-6577. We offer free consultations and charge you only if we win your case.

Contact us online or call (954) 504-6577 to learn more during a free, confidential consultation.

Serving the entire state of Florida. We will take charge of your case and get you the compensation you justly deserve.

Our Distinguished Team

When Your Benefits Matter, It Matters Who You Hire

-

Aggressive, Experienced, and Compassionate Counsel

-

Client Centered Approach

-

Spanish-Speaking Services

-

Access to Call or Text Your Attorney Anytime

-

Work Directly With Your Attorney

Whether you have questions or you’re ready to get started, our legal team is ready to help. Complete our form below or call us at (954) 504-6577.